Looking towards estate planning changes under new administration

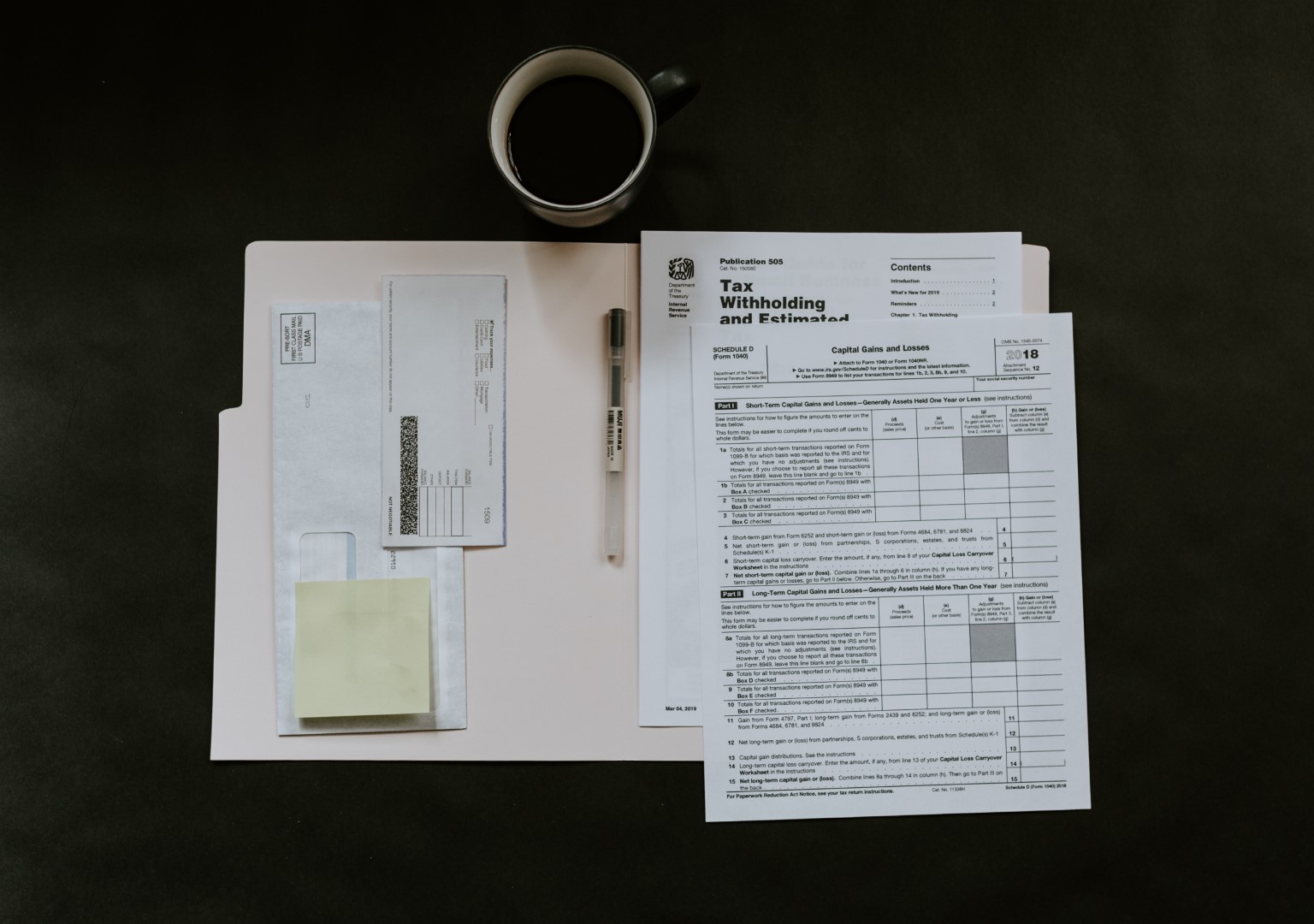

Tax changes are expected under the new administration. We don’t know how quickly President Joe Biden will move to enact his tax proposals, or whether the Democrats’ thin margin in Congress will be a moderating force. Many analysts believe that economic recovery will be the administration’s first priority, meaning we might not see immediate action. … Read more