We represent many persons who act in the trusted role of “fiduciary,” as successor trustee of a trust, executor of a will, administrator of an estate (when a person dies without a will) or other role. Fiduciaries often have a tough and thankless job. They must marshal assets, file tax returns and distribute property according to the will, trust and applicable laws. Fiduciaries who fail to work closely with a trusted advisor can make mistakes. Here’s a look at the most common ones:

Report from Counsel

Report from Counsel

Estate Planning Challenges

Planning when one or both spouses have been married in the past can also present challenges. For instance, suppose Mike and Helen, a married couple with no children, sign wills or trusts leaving their assets to each other outright. If Mike dies first, Helen will inherit everything. When Helen dies, who will get assets which … Read more

Moving an elderly relative? Think about state taxes

It’s a common scenario: An elderly relative is no longer able to live alone, so family members sell the relative’s house and have the relative start living with them or in a nursing home or assisted living facility that’s closer to the family.

One thing you might not consider

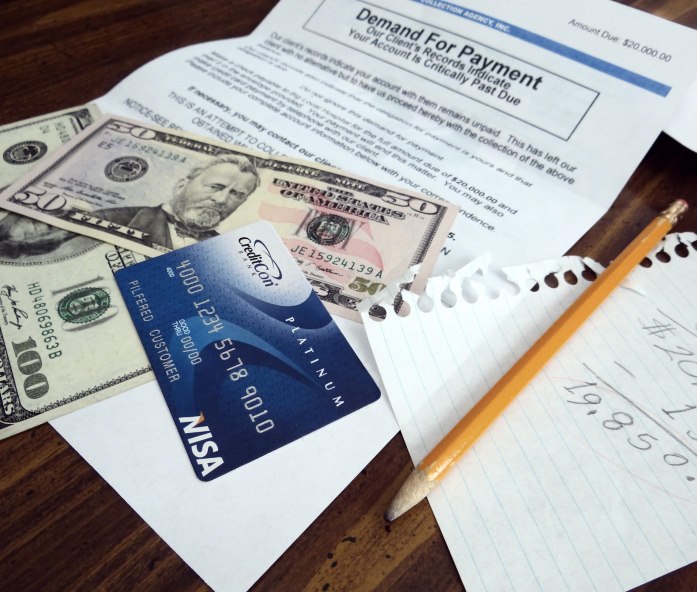

The advantages of making a list of assets and debts

Have you ever considered writing down a list of all your assets (with account numbers, passwords, and so on), as well as debts and recurring payments?

Making such a list and putting it in a secure place can be a godsend if something ever happens to you and you become incapacitated, because your family will have a much easier time looking after your affairs.

In a recent article in the Wall Street Journal, a middle-class couple described the extraordinary difficulties they faced when

Do-it-yourself will leads to an unfortunate result

Here’s yet another example of how people who try to create their own wills, using a form taken from a book or the Internet, often shoot themselves in the foot. George Zeevering of Pennsylvania wanted his estate to go to two of his five children. He wrote a “do-it-yourself” will in which he left his … Read more

Charitable donations from your IRA could save taxes

Congress has revived a law that lets you make charitable donations directly from your IRA, which might provide older people with some significant tax advantages.

The “IRA charitable rollover” was discontinued at the end of 2014. But Congress has now resurrected it, made it permanent, and also made it retroactive to the beginning of 2015.

If you’re over the age of 70½, you’re required to take minimum distributions each year from your IRA, and you have to pay income tax on those distributions. But the “charitable rollover” law lets you

New threats to online retailers

As more and more companies sell things online, especially to far-flung customers, it can be difficult to keep track of the ever-changing legal rules that apply. Here’s a look at just some of the issues on the horizon that online retailers should be aware of:

Is your website accessible to the disabled? You might be surprised at the idea that the federal Americans With Disabilities Act applies to online stores, but the U.S. Department of Justice has taken the position that it does, and is planning to issue rules soon for how retailers should comply.

It’s likely the government will soon require retail websites to do some or all of the following:

Government steps up audits of health care privacy

The federal government has begun a much more intensive program of auditing health care providers for violations of HIPAA, the federal law that protects patients’ privacy. For the first time, the government will be auditing not only health care providers but also related businesses to whom patients’ information might be disclosed – including third-party administrators, … Read more

Have you funded your living trust?

Once a living trust is in place (also called a declaration of trust), it is important to fund the trust in order to minimize future risk and expense. “Funding” a trust means changing the way the person who made the trust – called a grantor – holds title to his or her assets, from the … Read more

Some gifts to charity should be made now, not in your will

In the past, many people’s wills or trusts included a sizable donation to charity. Because the federal estate tax was so burdensome, including charitable bequests in a will or trust was a good idea since it reduced the amount of tax the estate had to pay. Now, however, the federal estate tax applies only to … Read more